全固态电池可能将是一个“炸雷”

梁锐还表示,“目前我国新能源产业在全球已形成自身竞争优势,但日、韩企业一直紧追不舍。最近大家都明显感觉到(全)固态电池可能将是我们所要面对的一个‘危机’。如果我们能实现突破,就能保持新能源产业的优势,在全球继续掌握发言权。相反,如果(全)固态电池被其他国家企业‘弯道超车’,我们则可能会失去部分新能源市场。”

实际上,固态电池(含半固态、凝聚态、凝胶态、全固态等电池类型)技术路线的发展一直饱受争议。虽然凭借高能量密度和安全性等多重优势,全固态电池被视为动力电池未来的终极形态,但研发面临一系列科学难题,导致业界对全固态电池的质疑之声不绝于耳。

其中,“全固态电池将如何实现产业化”“何时实现产业化”等问题成为业界讨论的焦点。

近日,中国科学院院士、清华大学教授欧阳明高表示,全固态电池是下一代电池技术竞争的关键制高点,相较液态电池具备颠覆性的技术潜力。从全行业看,中国既要发展渐近性的半固态技术路线,也要防范激进型全固态技术路线带来的颠覆性风险。

同时,据欧阳明高预判,全固态电池到2030年将有望实现产业化。

值得注意的是,不管是质疑,还是肯定,固态电池已经成为全球头部企业下“重注”的赛道,卡位布局成为很多企业的选择。进入2024年以来,全球固态电池领域更是动作频频,引起业界高度关注。

01

全球固态电池研发“攻势”

2024年1月2日,日本电池企业麦克赛尔(Maxell)宣布,其已经成功研发出一种新型圆柱形全固态电池(非动力型)。

1月4日,大众集团旗下电池子公司 PowerCo宣布已完成对QuantumScape固态电池的耐久性测试,并表示它未来可以为电动汽车提供动力,而且在车辆行驶50万公里后,电池续航几乎没有衰减。

另据市场消息,大众集团还在与法国博洛雷集团(Bollore)旗下子公司Blue Solutions讨论,将固态电池应用于汽车的相关事宜。据悉,Blue Solutions已经为戴姆勒的电动巴士生产固态电池。

1月16日,美国全固态电池企业Solid Power宣布,其与韩国企业SK On达成三项合作协议:研发许可、产线安装和电解质供应。Solid Power表示,除了授权技术研发,为SK On位于韩国的工厂安装固态生产线,Solid Power还将成为SK On重要的硫化物固态电解质供应商。

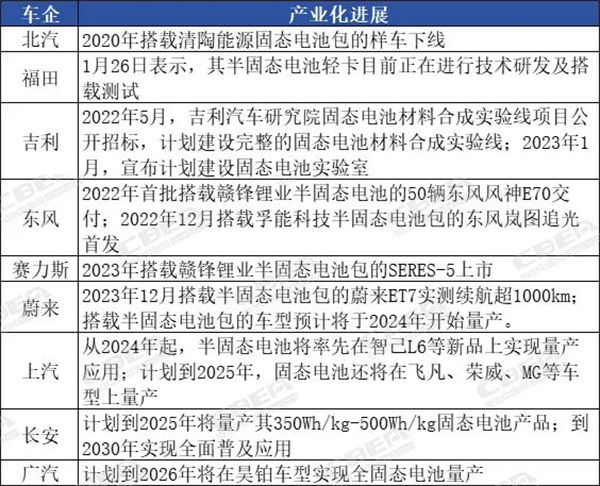

据观察,当前在固态电池技术路线的选择上,国外企业以全固态电池为主,国内企业是以固液混合电池、全固态电池路线并行。目前,国内部分车企固态电池应用进展如下:

资料显示,国内的上汽、蔚来有望在2024年量产搭载半固态电池包的车型,长安、广汽等也计划在2025-2026年推出各自的半固态电池车型;而海外的丰田、本田、现代、奔驰等车企则布局全固态电池,多计划将于2025-2030年量产相关车型。

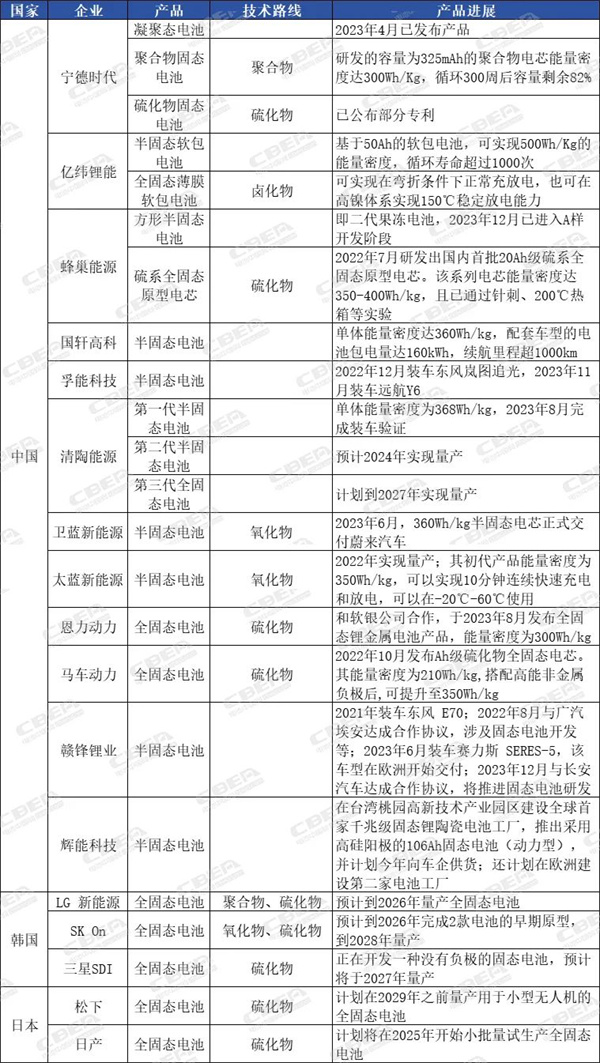

全球范围内,除了车企布局以外,包括宁德时代、亿纬锂能、卫蓝新能源、清陶能源、赣锋锂业、蜂巢能源、国轩高科、孚能科技、LG 新能源、SK On等头部电池企业,都在进行固态电池技术的研发和产业化落地。

国内企业中,亿纬锂能、蜂巢能源等企业在全固态电池研发进度上领先;孚能科技、清陶能源、卫蓝新能源、赣锋锂业半固态电池产品已实现装车;多家厂商半固态电池产品具备量产能力。

2023年8月,清陶能源完成与上汽联合开发的第一代半固态电池装车试验,测试车辆最大续航里程达到1083公里,将于今年在上汽智己汽车平台上实现量产。其计划在2027年实现第三代全固态电池量产。

孚能科技2023年11月宣布,搭载其半固态电池的远航Y6正式下线,后者为大运集团旗下豪华新能源车型。孚能科技表示,其半固态电池已在多款品牌车型落地。

2023年12月,蜂巢能源推出方形半固态电池,即二代果冻电池新品。蜂巢能源还透露,正在就二代果冻电池新品洽谈一项百亿级的合作。

近日,欣旺达在投资者互动平台也表示,自2020年开始在固态电池材料、电极和电芯结构,以及界面改性等方面布局相关专利,目前其已拥有固态电池相关核心专利十余件。同时,其固态电池产品处于实验室研发阶段,后续将根据客户需求进行配套量产。

不过,固态电池产业化落地并非易事。业界人士分析指出,“半固态是将电解液含量从1逐渐减少趋于0,但全固态电池完全去除电解液,整个体系就变了,要完全解决固-固(固态电极与固态电解质)界面等各种问题。”

事实上,自2008年就开始研发全固态电池的丰田,就将其全固态电池预计量产时间从原来的2027年推迟到了2030年以后,这也佐证了全固态电池研发难度之大,不容小觑。

02

固态电池需求将颠覆传统锂电上游格局

市场方面,据粗略统计,2023年国内半固态电池出货量达GWh级别。国信证券预计,2024年全球固态电池(含半固态电池)需求量或达2.3GWh,市场空间约19.5亿元。到2030年,全球固态电池需求量有望达到220GWh,2024-2030年均复合增速或达114%;市场空间有望达到1162.3亿元,2024-2030年均复合增速约98%。

在电池中国看来,固态电池远期具有高市场需求,而研发固态电池,尤其是全固态电池,并实现产业化,不仅需要产业链上下游深度协作,而且将对上下游带来颠覆性的挑战和机遇:

一是电解质领域,硫化物、聚合物、氧化物、卤化物等多技术路线并行,目前布局硫化物路线的企业较多。各技术路线的研发和验证过程中,在固-固界面接触、界面反应机制与稳定性、电导率、制作工艺等方面,都面临大量技术难点,甚至需要与正极材料等进行联合研发和验证。

二是正极领域,目前,硫化物全固态电池用高镍三元正极材料等关键材料成为正极材料企业研发重点,当升科技、容百科技等头部企业均已布局。未来,将从高镍三元,向高电压高镍三元、超高镍三元,再向尖晶石镍锰酸锂、层状富锂基等新型正极材料升级。

三是负极领域,能量密度更高的硅基负极,是现阶段较具潜力的新型负极材料,杉杉科技、贝特瑞、翔丰华等头部企业均已布局,部分企业样品已处于客户测试阶段。而未来,全固态电池负极则可能向金属锂方向迭代。

四是隔膜领域,虽然半固态电池仍需要从传统隔膜向氧化物涂覆隔膜升级,但未来全固态电池时代,固-固界面影响下,隔膜将逐渐消失。

五是设备领域,随着固态电池材料和电芯技术、工艺的革新,也将对制造设备产生翻天覆地的变化,创新涂覆、叠片方式等势必需要研发新型设备。

六是下游领域,拓宽固态电池应用场景,将更有利于加快产业化进程。如宁德时代凝聚态电池将率先应用于飞行器等领域。

当前,各国均处于固态电池技术和量产的闯关阶段,我国产业链企业的优势在于拥有全球最大的新能源汽车市场以及头部企业,不过仍需持续提升关键材料等产业链研发和支持能力,从而打好汽车强国、保持全球领先地位的关键一战。

"Solid state batteries (all) may be a 'bomb', and once they are mass-produced, many of our current production capacity will immediately become a huge 'burden'." In early January of this year, Liang Rui, Vice President of Xinwangda, said at the Li+Society event held by Battery China Network.

Liang Rui also stated that, At present, China's new energy industry has formed its own competitive advantage globally, but Japanese and South Korean companies have been closely following suit. Recently, everyone has clearly felt that (all) solid-state batteries may be a 'crisis' that we will face. If we can achieve breakthroughs, we can maintain the advantages of the new energy industry and continue to have a say in the world. On the contrary, if (all) If solid-state batteries are overtaken by companies from other countries, we may lose some of the new energy market

In fact, the development of solid-state battery technology (including semi-solid, condensed, gel, all solid and other battery types) has always been controversial. Although solid-state batteries are considered the ultimate form of power batteries in the future due to their multiple advantages such as high energy density and safety, research and development face a series of scientific challenges, leading to constant questioning of solid-state batteries in the industry.

Among them, issues such as "how to achieve industrialization of all solid state batteries" and "when to achieve industrialization" have become the focus of industry discussion.

Recently, Ouyang Minggao, an academician of the Chinese Academy of Sciences and a professor at Tsinghua University, stated that all solid state batteries are the key high ground for competition in next-generation battery technology, and have disruptive technological potential compared to liquid state batteries. From the perspective of the entire industry, China should not only develop an asymptotic semi-solid technology route, but also guard against the disruptive risks brought by the radical all solid technology route.

Meanwhile, according to Ouyang Minggao's prediction, all solid-state batteries are expected to achieve industrialization by 2030.

It is worth noting that whether questioned or affirmed, solid-state batteries have become a "heavy investment" track for global leading enterprises, and card layout has become a choice for many enterprises. Since entering 2024, the global solid-state battery industry has been taking frequent actions, attracting high attention from the industry.

01

Global Solid State Battery R&D Offensive

On January 2, 2024, Japanese battery company Maxell announced that it had successfully developed a new type of cylindrical all solid state battery (non power type).

On January 4th, PowerCo, a battery subsidiary of Volkswagen Group, announced that it had completed durability testing on QuantumScape solid-state batteries and stated that it could provide power for electric vehicles in the future, with almost no degradation in battery range after driving 500000 kilometers.

According to market reports, Volkswagen Group is still in discussions with Blue Solutions, a subsidiary of Bollore Group in France, regarding the application of solid-state batteries in automobiles. It is reported that Blue Solutions has produced solid-state batteries for Daimler's electric buses.

On January 16th, American solid-state battery company Solid Power announced that it has reached three cooperation agreements with South Korean company SK On: research and development licensing, production line installation, and electrolyte supply. Solid Power stated that in addition to authorizing technology research and development and installing solid-state production lines for SK On's factory in South Korea, Solid Power will also become an important supplier of sulfide solid electrolytes for SK On.

According to observations, in the current selection of solid-state battery technology routes, foreign enterprises mainly focus on all solid-state batteries, while domestic enterprises parallel the routes of solid-liquid hybrid batteries and all solid-state batteries. At present, the application progress of solid-state batteries in some domestic car companies is as follows:

All solid state batteries may be a "bomb"

According to data, SAIC and NIO in China are expected to mass produce models equipped with semi-solid battery packs in 2024, while Changan and GAC also plan to launch their own semi-solid battery models from 2025 to 2026; Overseas car companies such as Toyota, Honda, Hyundai, and Mercedes Benz are laying out all solid-state batteries, with many plans to mass produce related models from 2025 to 2030.

On a global scale, in addition to automotive companies, leading battery companies such as CATL, Yiwei Lithium Energy, Weilan New Energy, Qingtao Energy, Ganfeng Lithium, Honeycomb Energy, Guoxuan High tech, Funeng Technology, LG New Energy, SK On, etc. are all conducting research and industrialization of solid-state battery technology.

All solid state batteries may be a "bomb"

Among domestic enterprises, companies such as Yiwei Lithium Energy and Honeycomb Energy are leading in the research and development progress of all solid state batteries; Funeng Technology, Qingtao Energy, Weilan New Energy, and Ganfeng Lithium's semi-solid battery products have been installed on vehicles; Multiple manufacturers have mass production capabilities for semi-solid state battery products.

In August 2023, Qingtao Energy completed the first generation semi-solid battery installation test jointly developed with SAIC, and the maximum range of the test vehicle reached 1083 kilometers. It will be mass-produced on the SAIC Zhiji Automotive platform this year. It plans to achieve mass production of third-generation all solid-state batteries by 2027.

In November 2023, Funeng Technology announced that the Far East Y6, equipped with its semi-solid state battery, was officially launched, which is a luxury new energy vehicle under the Dayun Group. Funeng Technology stated that its semi-solid state batteries have been implemented in multiple brand models.

In December 2023, Honeycomb Energy launched a new product called the square semi-solid battery, the second-generation jelly battery. Honeycomb Energy also revealed that it is negotiating a billion dollar cooperation on a new second-generation jelly battery product.

Recently, Xinwangda also stated on the investor interaction platform that it has been laying out related patents in solid-state battery materials, electrodes and cell structures, as well as interface modification since 2020. Currently, it has more than ten core patents related to solid-state batteries. At the same time, its solid-state battery products are in the laboratory research and development stage, and will be mass-produced according to customer needs in the future.

However, the industrialization of solid-state batteries is not an easy task to implement. Industry analysts point out that "semi-solid state gradually reduces the electrolyte content from 1 to 0, but when the electrolyte is completely removed from an all solid state battery, the entire system changes. It is necessary to completely solve various problems such as the solid-solid (solid electrode and solid electrolyte) interface."

In fact, Toyota, which has been developing all solid state batteries since 2008, has postponed its expected production time for all solid state batteries from 2027 to after 2030, which also proves the difficulty of developing all solid state batteries and cannot be underestimated.

02

The demand for solid-state batteries will overturn the upstream pattern of traditional lithium batteries

In terms of the market, according to rough statistics, the domestic shipment of semi-solid batteries reached the GWh level in 2023. Guoxin Securities predicts that the global demand for solid-state batteries (including semi-solid batteries) may reach 2.3GWh in 2024, with a market space of approximately 1.95 billion yuan. By 2030, the global demand for solid-state batteries is expected to reach 220GWh, with a compound annual growth rate of 114% from 2024 to 2030; The market space is expected to reach 116.23 billion yuan, with a compound annual growth rate of approximately 98% from 2024 to 2030.

In the view of Battery China, solid-state batteries have high market demand in the long term. Developing solid-state batteries, especially all solid-state batteries, and achieving industrialization not only requires deep cooperation between the upstream and downstream of the industry chain, but also will bring disruptive challenges and opportunities to the upstream and downstream:

One is in the field of electrolytes, where multiple technological routes such as sulfides, polymers, oxides, halides, etc. are parallel. Currently, there are many enterprises that layout sulfide routes. In the research and verification process of various technical routes, there are many technical difficulties in solid-solid interface contact, interface reaction mechanism and stability, conductivity, production process, etc., and even joint research and verification with positive electrode materials are needed.

The second is in the field of positive electrodes. Currently, key materials such as high nickel ternary positive electrode materials for sulfide all solid state batteries have become the focus of research and development for positive electrode material enterprises. Leading enterprises such as Dangsheng Technology and Rongbai Technology have already laid out their positions. In the future, we will upgrade from high nickel ternary to high voltage high nickel ternary, ultra-high nickel ternary, and then to new cathode materials such as spinel nickel manganese oxide lithium and layered lithium rich base.

Thirdly, in the field of negative electrodes, silicon-based negative electrodes with higher energy density are currently a promising new type of negative electrode material. Leading companies such as Shanshan Technology, Betray, and Xiangfenghua have already laid out their products, and some of their samples are already in the customer testing stage. In the future, the negative electrode of all solid-state batteries may iterate towards metallic lithium.

The fourth is in the field of separators. Although semi-solid state batteries still need to upgrade from traditional separators to oxide coated separators, in the future era of all solid state batteries, separators will gradually disappear under the influence of the solid-solid interface.

The fifth is in the field of equipment. With the innovation of solid-state battery materials, cell technology, and processes, manufacturing equipment will also undergo revolutionary changes. Innovative coating and stacking methods will inevitably require the development of new equipment.

Sixth, in the downstream field, expanding the application scenarios of solid-state batteries will be more conducive to accelerating the industrialization process. Ningde Era condensed state batteries will be the first to be applied in fields such as aircraft.

At present, all countries are in the stage of breakthroughs in solid-state battery technology and mass production. The advantage of China's industrial chain enterprises lies in having the world's largest new energy vehicle market and leading enterprises. However, it is still necessary to continue to improve the research and development and support capabilities of key materials and other industrial chains, in order to play a key role in building a strong automotive country and maintaining a global leading position.